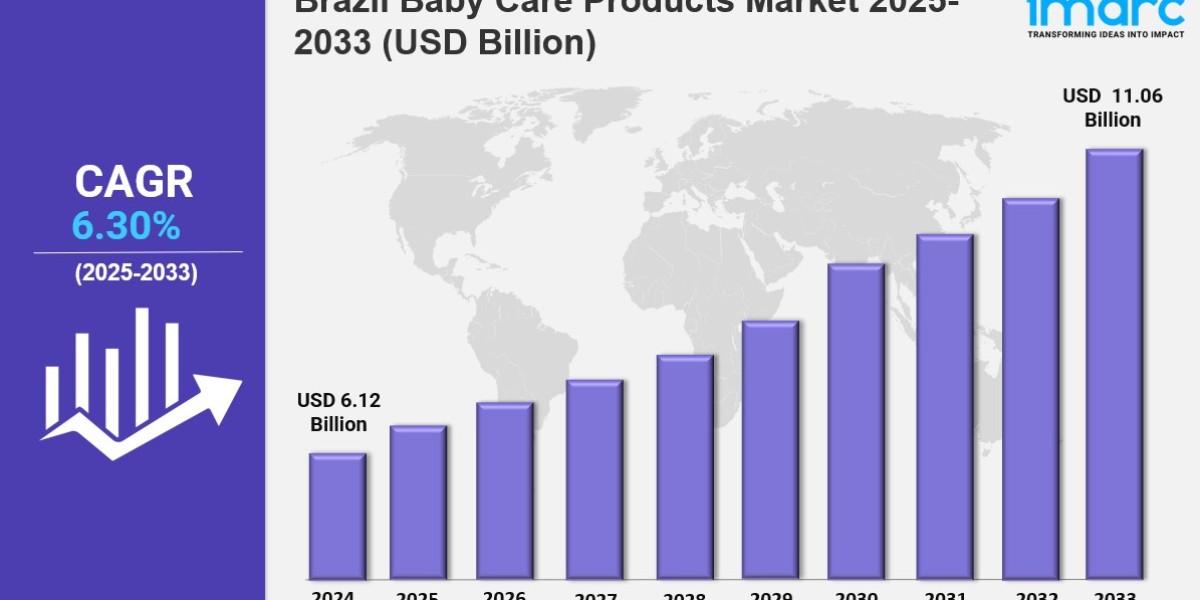

Market Overview 2025-2033

The Brazil baby care products market size reached USD 6.12 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.06 Billion by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The market is expanding due to rising birth rates, increasing parental awareness, and growing demand for organic and premium products. E-commerce growth, innovation in formulations, and sustainability trends are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by increasing parental awareness and demand for premium baby products

✔️ Rising preference for organic, hypoallergenic, and sustainable baby care solutions

✔️ Expanding availability through supermarkets, pharmacies, and e-commerce platforms

Request for a sample copy of the report: https://www.imarcgroup.com/brazil-baby-care-products-market/requestsample

Brazil Baby Care Products Market Trends and Drivers:

The market for brazil baby care products share is Natural and organic products are becoming more and more popular. Today's parents are aware of the dangers of artificial chemicals in baby care items. They look for natural options because of this understanding. Parents are more concerned about their children's health and want the best for them. Companies that offer organic diapers, shampoos, and lotions for babies are growing in popularity. These items meet the safe and environmentally friendly solutions that parents seek are met by these items. Additionally, the Brazilian government is in favor of personal care products that contain natural substances.

Manufacturers are encouraged to alter their formulae as a result. These days, businesses are spending money on research and development. Their goal is to develop cutting-edge organic products that satisfy consumer demands. The market for baby care items is being impacted by Brazil's rapidly expanding e-commerce industry. Due to its convenience, more parents are preferring to purchase online, which is encouraging firms to increase their online visibility. This trend was accelerated by the COVID-19 epidemic, as more consumers resorted to internet shopping.

E-commerce gives parents a wider selection of products. It also allows them to compare prices and read reviews before buying. Major retailers and smaller brands are investing in easy-to-use websites and mobile apps to improve the shopping experience. Additionally, social media marketing and influencer partnerships are key strategies for reaching target audiences. This is especially true for millennials and Gen Z parents, who prefer shopping online. This shift to e-commerce is set to keep growing, with forecasts showing significant increases in online sales of baby care products through 2024 and beyond.

Brazil's economy is changing. Rising disposable incomes and urbanization are boosting the baby care products market. More families are moving to cities and earning higher incomes. They are willing to spend more on premium baby care items. Urban parents want high-quality products that ensure safety, effectiveness, and convenience. This shift is leading to stronger brand loyalty. Consumers are increasingly choosing well-known brands recognized for quality and trustworthiness.

Moreover, marketing strategies aimed at urban customers are getting smarter. Companies are using data analytics to understand how people buy and what they prefer. As a result, businesses are adjusting their products to meet the needs of urban families. This focus is driving innovation and competition in the market. In the Brazilian baby care products market, sustainability is a key trend.

Parents care more about the environment now. They want products that are safe for their kids and eco-friendly. Brands are reacting by making biodegradable diapers, refillable packaging, and goods from renewable resources. This trend will keep growing through 2024. Consumers want clear info on where ingredients come from and how products are made. Companies that adopt sustainable practices can improve their image and gain loyal customers.

Sustainability in product development is not just a trend; it marks a shift toward responsible consumption. Retailers are showcasing eco-friendly options, and campaigns are teaching parents about the benefits. As the market changes, focusing on sustainability will influence consumer choices and spark innovation in baby care.

Brazil Baby Care Products Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product Type:

Baby Skin Care

Baby Hair Care

Baby Toiletries

Baby Bath Products and Fragrances

Baby Diapers and Wipes

Baby Food and Beverages

Breakup by Category:

Premium

Mass

Breakup by Distribution Channel:

Supermarkets and Hypermarkets

Convenience Stores

Pharmacies/Drug Stores

Online Stores

Others

Breakup by Region:

Southeast

South

Northeast

North

Central-West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145