As an experienced forex trader, I have come to understand the massive potential and opportunities that the forex market offers. Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies to make a profit. The forex market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. In this article, I will guide you through the essential skills and techniques that are crucial for success in forex trading.

Understanding the Forex Market

Before diving into forex trading, it is essential to have a solid understanding of the forex market. The forex market operates 24 hours a day, five days a week, allowing traders to participate from anywhere in the world. It is a dispersed market, meaning that there is no central exchange where all the trades take place. Instead, trading is conducted electronically over-the-counter (OTC), which means that all transactions are done through computer networks between traders around the globe.

The forex market consists of currency pairs, where one currency is bought while the other is sold. The value of a currency pair is determined by various factors such as economic indicators, geopolitical events, and market reaction. It is important for traders to analyze these factors and make informed decisions based on their research and technical analysis.

The Basics of Forex Trading

To begin your forex trading journey, it is crucial to grasp the basics of how the market works. The first step is to open a trading account with a decent forex broker. Choose a broker that offers a user-friendly trading platform, competitive spreads, and reliable customer support. Once you have opened an account, you can start practicing trading with a demo account. This allows you to explain yourself with the trading platform and test your strategies without risking real money.

In forex trading, you have the option to go long or short on a currency pair. Going long means buying a currency with the expectation that its value will rise, while going short means selling a currency with the expectation that its value will fall. It is important to note that forex trading involves leverage, which allows you to control a larger position with a smaller amount of capital. While leverage can amplify your profits, it can also increase your losses, so it is crucial to use it wisely and manage your risk effectively.

The Importance of Forex Trading Skills

To become a successful forex trader, it is essential to develop certain skills that will set you apart from the crowd. One of the most important skills is discipline. Forex trading requires a disciplined approach, as it is easy to let emotions take over and make thoughtless decisions. Stick to your trading plan, set realistic goals, and avoid chasing after quick profits. Patience is also a key skill, as forex trading is not a get-rich-quick scheme. It takes time and practice to develop a profitable trading strategy.

Another crucial skill in forex trading is risk management. Always determine your risk tolerance and set stop-loss orders to limit your losses. Never risk more than you can afford to lose, and always have a clear exit strategy in place. Additionally, being able to analyze charts and understand technical indicators is vital for making informed trading decisions. Learn to identify trends, support and resistance levels, and other patterns that can help you predict future price movements.

Essential Techniques for Successful Forex Trading

When it comes to forex trading, there are several techniques that can greatly improve your chances of success. One such technique is fundamental analysis, which involves analyzing economic indicators, central bank announcements, and geopolitical events to predict currency movements. Stay updated with the latest news and economic data that can impact the forex market.

Another technique is technical analysis, which involves analyzing past price movements and using various indicators and chart patterns to predict future price movements. Learn to use popular technical indicators such as moving averages, MACD, and RSI to identify entry and exit points.

Furthermore, developing a trading strategy is essential for consistent profitability. A trading strategy outlines your approach to the market, including your entry and exit rules, risk management techniques, and the time frames you will trade on. Back test your strategy using historical data to ensure its effectiveness before applying it to live trading.

The Stop-Loss in Forex Trading in Depth with Examples

The stop-loss order is a powerful tool that every forex trader should utilize. It is a predetermined level at which you will exit a trade to limit your losses. Setting a stop-loss order is crucial for risk management and protecting your capital. Without a stop-loss order, you are exposed to unlimited losses if the market moves against your position.

Let’s take an example to understand how the stop-loss works. Suppose you enter a long position on the EUR/USD currency pair at 1.2000 with a stop-loss order set at 1.1950. This means that if the price reaches 1.1950, your trade will automatically be closed, limiting your loss to 50 pips. Setting a stop-loss order ensures that you are not emotionally attached to a losing trade and allows you to move on to the next opportunity.

Risk Management in Forex Trading

Risk management is a crucial aspect of forex trading that cannot be ignored. It involves identifying and managing the risks associated with trading to protect your capital and minimize losses. Here are some key risk management techniques that every forex trader should implement:

- Determine Your Risk Tolerance: Before entering a trade, assess how much risk you are willing to take. This will help you determine the appropriate position size and the maximum amount you are willing to lose.

- Set Stop-Loss Orders: As mentioned earlier, setting stop-loss orders is essential for limiting losses. Always set a stop-loss order when entering a trade and adjust it as the trade progresses to lock in profits or reduce losses.

- Use Proper Position Sizing: Position sizing refers to the number of lots or units you trade. It is important to calculate your position size based on your risk tolerance and the distance to your stop-loss level. This ensures that you are not risking too much on a single trade.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket by diversifying your trades. Trade different currency pairs and consider other asset classes such as supplies or keys to spread your risk.

- Keep Emotions in Check: Emotions can cloud your judgment and lead to impulsive decisions. Stick to your trading plan and avoid making emotional trades based on fear or greed.

By applying these risk management techniques, you can protect your capital and ensure long-term success in forex trading.

Legal Aspects of Forex Trading in Pakistan

Forex trading in Pakistan operates under the regulations of the Securities and Exchange Commission of Pakistan (SECP). The SECP is responsible for overseeing the financial markets and ensuring the protection of investors’ interests. It is legal for Pakistani residents to engage in forex trading, provided they do so through a licensed broker.

When choosing a forex broker in Pakistan, make sure to verify their regulatory status with the SECP. Licensed brokers are required to follow strict regulations, including the segregation of client funds, ensuring fair trading conditions, and providing transparent pricing. By trading with a regulated broker, you can have peace of mind knowing that your funds are protected and that you are trading in a secure environment.

Forex Trading Strategies and Tips

To succeed in forex trading, it is important to develop a trading strategy that suits your trading style and objectives. Here are some popular forex trading strategies:

- Trend Following: This strategy involves identifying trends in the market and trading in the direction of the trend. Traders using this strategy aim to capture large moves in the market.

- Breakout Trading: Breakout traders look for price levels where the market breaks out of a range or a specific pattern. They enter trades when the price breaks above resistance or below support levels.

- Range Trading: Range traders identify price levels where the market tends to bounce between support and resistance. They enter trades when the price reaches the upper or lower boundaries of the range.

- Scalping: Scalpers aim to make small profits from quick trades. They enter and exit trades within minutes or even seconds, taking advantage of small price variations.

Regardless of the strategy you choose, here are some important tips to keep in mind:

- Stick to your trading plan and avoid impulsive decisions.

- Practice proper risk management to protect your capital.

- Keep a trading journal to track your trades and learn from your mistakes.

- Stay updated with the latest news and economic data that can impact the forex market.

- Continuously educate yourself and stay well-informed of new developments and trading techniques.

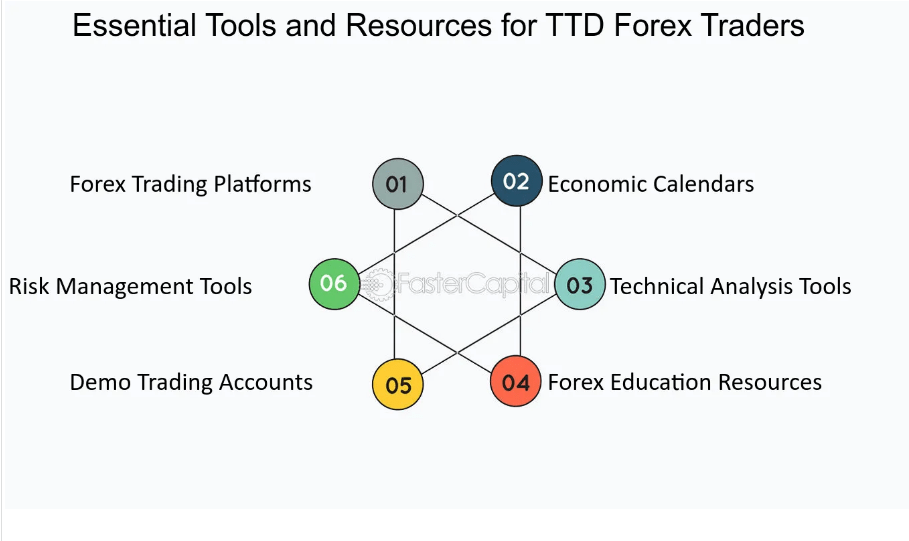

Forex Trading Tools and Resources

To enhance your trading experience and improve your chances of success, there are several tools and resources available to forex traders. Here are some essential ones:

- Trading Platforms: Choose a user-friendly trading platform that provides real-time market data, advanced charting tools, and the ability to execute trades effortlessly.

- Economic Calendar: An economic calendar provides a schedule of upcoming economic events, such as central bank announcements and economic indicators releases. It helps you stay informed about potential market-moving events.

- Technical Analysis Tools: Use popular technical analysis tools such as moving averages, MACD, and RSI to analyze price charts and identify trends and trading opportunities.

- Trading Education: Invest in your trading education by enrolling in online courses, attending webinars, or reading books on forex trading. Continuous learning is crucial for staying ahead in the ever-changing forex market.

- Trading Communities: Join online trading communities or forums where you can interact with fellow traders, share ideas, and learn from each other’s experiences. Networking with other traders can provide valuable insights and support.

Conclusion and Next Steps

Mastering forex trading requires time, dedication, and continuous learning. By understanding the forex market, developing essential skills, employing effective techniques, and managing risks, you can increase your chances of success in this exciting and dynamic industry.

As a next step, open a demo account with a reputable forex broker and start practicing your trading strategies. Take advantage of the educational resources and tools available to you and stay committed to your trading goals. Remember, consistency and discipline are the keys to long-term profitability in forex trading.

Now that you have the essential skills and techniques, it’s time to begin your forex trading journey with confidence. Start small, manage your risks, and always strive to improve your trading skills. With time and experience, you can become a successful forex trader. Happy trading!

Open a demo account with a reputable forex broker and start practicing your trading strategies today.

Stay tuned for our upcoming blogs where we’ll explain the modern recruiting trends and challenges Don’t miss out—subscribe to our newsletter or follow us on social media for timely updates on our forthcoming articles.

Visit our website to read latest articles: https://workonpeak.org/blogs/