How to Choose a Reputable Pawnshop

When looking for a pawnshop loan, it's important to determine on a good and trustworthy pawnshop to make sure a smooth experience.

How to Choose a Reputable Pawnshop

When looking for a pawnshop loan, it's important to determine on a good and trustworthy pawnshop to make sure a smooth experience. Start by researching local pawnshops, looking for established companies with optimistic customer critiques. It's also useful to check several shops to get a sense of their presents and circumstan

Causes of Delinquent Loans

Several elements contribute to the emergence of delinquent loans. One of the primary reasons is financial hardship, which may stem from job loss, medical emergencies, or unexpected bills. When individuals face important monetary pressures, prioritizing loan repayments can turn into diffic

Many lenders could impose charges such as processing fees, late fees, or prepayment penalties. Therefore, it's important for borrowers to read the mortgage agreement rigorously to know all associated costs. Informed debtors who compare various lenders can usually find better phrases with fewer hidden char

Benefits of Auto Loans

Auto loans provide quite a few benefits for shoppers. Firstly, they offer a way to purchase a vehicle without needing to have the whole value upfront. This monetary flexibility permits individuals to invest in a dependable mode of transportation without vital preliminary out

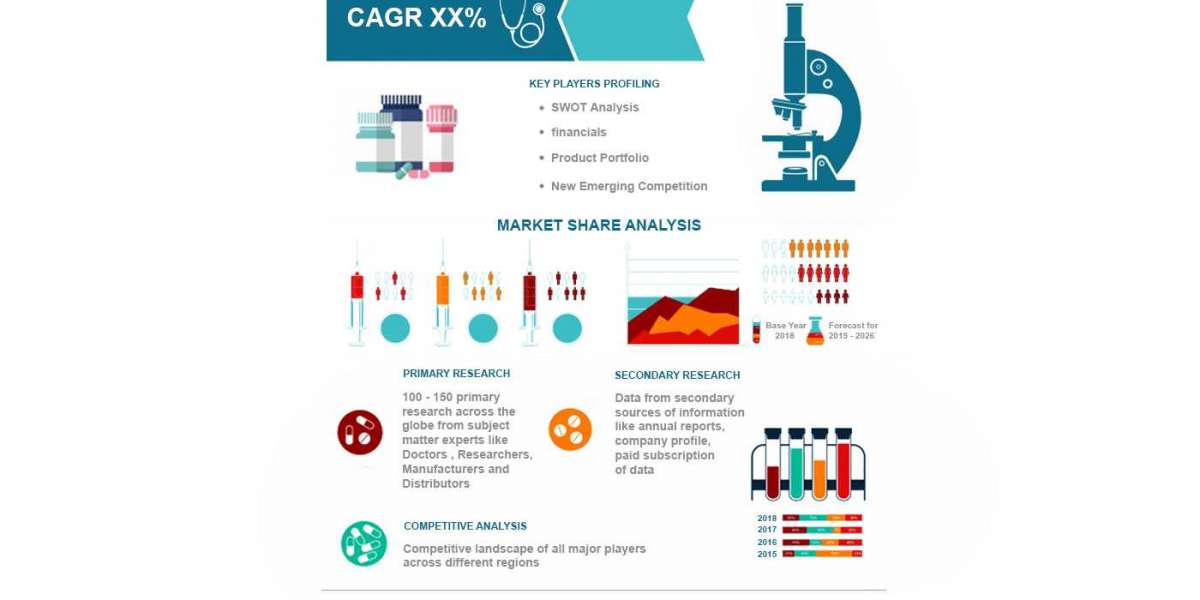

Factors Influencing Loan Approval

Loan for Women approval isn't assured, as several components can affect a lender's determination. Key components embody your credit score score, income stability, and debt-to-income ratio. Lenders usually use credit score scores to gauge your creditworthiness and assess the chance concerned in lending you mo

Individuals need to remember of the potential dangers related to these loans. For instance, piling on debt without a stable compensation plan can lead to further monetary instability. Experts recommend considering all elements earlier than continuing, ensuring that one’s monetary technique aligns with their current scenario. Managing credit responsibly is essential. Taking on an extreme amount of debt could create a cycle of financial distress that's onerous to escape f

Furthermore, 24-hour loans usually require much less rigorous credit score checks. While this might be advantageous for those with less-than-perfect credit score histories, it is important for borrowers to acknowledge that this will likely also lead to higher rates of inter

Another benefit is the **speed** with which funds are disbursed. In many cases, as quickly as the application is permitted, the money is deposited instantly into the borrower’s bank account inside hours. This permits individuals to handle pressing financial wants rapidly, whether it's to cowl unexpected medical payments, automobile repairs, or different pressing bi

Frequently Asked Questions about Delinquent Loans

What steps should I take if my mortgage turns into delinquent?

If your mortgage enters delinquency, immediate action is crucial. First, assess your financial situation and formulate a plan to compensate for funds. Communicate with your lender to discuss choices like loan modifications or cost plans. Furthermore, contemplate in search of monetary counseling for broader help in managing debts successfu

Types of Auto Loans

There are a quantity of types of auto loans, every catering to completely different wants and circumstances. The most common varieties embody conventional auto loans, lease buyouts, and personal loans used for buying automobi

Creating an emergency fund is another pivotal technique for safeguarding against future monetary hardships. By having funds put aside, debtors

Additional Loan can better handle unforeseen circumstances without compromising their capability to satisfy loan obligati

Importance of Timely Payments

Making timely payments is the simplest approach to avoid the repercussions of delinquency. Establishing a constant fee schedule not solely helps keep an excellent credit score but additionally fosters wholesome financial habits. It’s advisable to allocate sources particularly for mortgage funds somewhat than using discretionary inc

If the borrower accepts the mortgage, they receive cash upfront, and the pawnshop retains the item until the loan, plus any curiosity and charges, is paid off. If the borrower fails to repay the mortgage throughout the agreed timeframe, the pawnshop retains ownership of the merchandise and may sell it to get well their prices. This system allows fast entry to cash with out requiring prolonged credit score checks or documentat

One key aspect of any loan is the interest rate. Factors affecting it embrace your credit score score, the size of the loan, and prevailing market charges. Typically, people with greater credit score scores benefit from lower rates of interest, making it essential to maintain an excellent credit score historical past before applying for any financing. Borrowers ought to evaluate charges from totally different lenders to safe the most effective deal possi

Hướng dẫn mua thực phẩm online nhanh chóng qua app chợ

By minajasminej

Hướng dẫn mua thực phẩm online nhanh chóng qua app chợ

By minajasminej Üsküdar elektrikçi firması

Üsküdar elektrikçi firması

Navigating the Pickleball Paddle Market A Guide to the Best Options for Beginners

Navigating the Pickleball Paddle Market A Guide to the Best Options for Beginners

Revolutionize Your Business with WOL3D Coimbatore’s Unparalleled 3D Printing Services in Coimbatore

Revolutionize Your Business with WOL3D Coimbatore’s Unparalleled 3D Printing Services in Coimbatore

Free Video Chat Without Registration

By worksale

Free Video Chat Without Registration

By worksale